Defining an Invoice: A Request for Payment

An invoice is basically a bill. It’s a document a seller sends to a buyer, listing the goods or services provided and asking for payment. Think of it as a formal request for money owed. It details what was sold, how much it costs, and when the payment is due. This makes the invoice a key part of the sales process, especially when a business provides services or goods on credit.

The invoice clearly states the amount the buyer owes. It’s not just a list; it’s a demand for payment. Without a proper invoice, it’s hard for a business to track what payments are outstanding. This document helps keep the financial records straight and ensures the seller gets paid for their work or products. It’s a professional way to handle billing.

Key details on an invoice usually include:

- Invoice number (unique identifier)

- Date of issue

- Seller’s and buyer’s contact information

- Description of goods or services

- Total amount due

- Payment terms and due date

Defining a Receipt: Proof of Payment

A receipt, on the other hand, is the opposite. It’s a document given after payment has been made. It acts as proof that the transaction is complete and the money has been received. For the buyer, a receipt is proof of purchase. For the seller, it’s confirmation that they’ve received the funds. It’s a record that the debt has been settled.

This document is important for many reasons. Buyers might need a receipt for returns, warranty claims, or just to keep track of their spending. Businesses use receipts to confirm income and for their own accounting records. It shows that the money has changed hands and the sale is finalized. A receipt is the final word on a completed payment.

Here’s what you typically find on a receipt:

- Date of transaction

- Description of items or services purchased

- Total amount paid

- Payment method (cash, card, etc.)

- Seller’s name or store

The Fundamental Distinction in Purpose

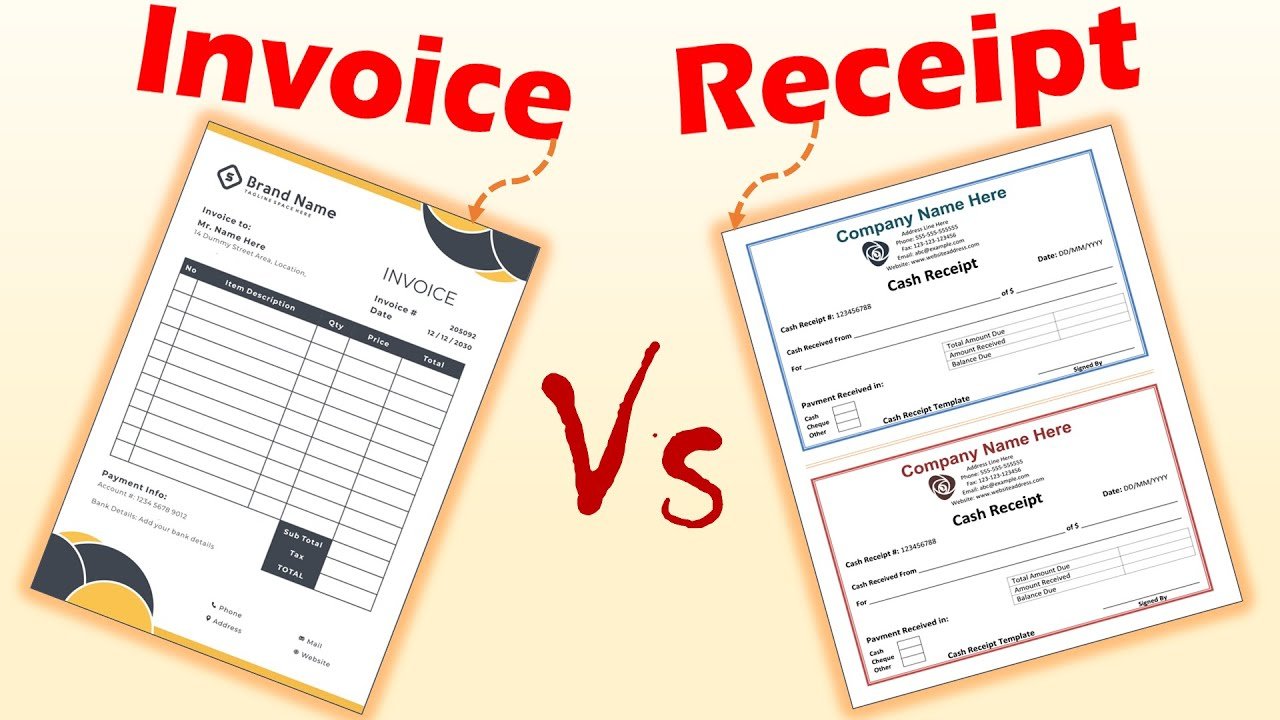

The main difference between an invoice and a receipt comes down to timing and purpose. An invoice is sent before payment to request it, while a receipt is given after payment to confirm it. One asks for money, the other says money was received. This distinction is really important for managing finances correctly.

Understanding the difference between an invoice and a receipt is not just about paperwork; it’s about clear financial communication and accurate record-keeping. Each document serves a distinct role in the lifecycle of a business transaction.

Using these documents correctly helps businesses track money coming in and going out. It prevents confusion about who owes what and when. For any business, getting this right means better financial health and fewer headaches down the line. The invoice starts the payment process, and the receipt closes it.

Key Components and Timing of Each Document

Essential Elements of an Invoice

An invoice is basically a formal request for payment. It needs to be clear about what’s being billed and when it’s due. This is where invoice and receipt differences matter most: the invoice requests payment before it’s received, while a receipt is the proof you issue after the payment is completed. Think of it as the ‘what and how much’ before the money changes hands. A good invoice usually includes the seller’s contact details, a unique invoice number for tracking, the date it was issued, and a list of the goods or services provided. Each item should have a description, quantity, and price. It also needs to show the subtotal, any applicable taxes, and the final amount due. Payment terms, like when the payment is expected and how it can be made, are also super important.

The invoice number is key for keeping track of all your sales. Without it, things can get messy fast. It helps both the buyer and seller reference the specific transaction later on. It’s also good practice to include the buyer’s contact information so they know who the bill is for. This document sets the stage for the payment process, so getting all these details right is pretty vital.

Here’s a quick rundown of what you’ll typically find on an invoice:

- Seller’s Business Name and Contact Info

- Buyer’s Name and Contact Info

- Unique Invoice Number

- Invoice Date

- Itemized List of Goods/Services (Description, Quantity, Price per Unit)

- Subtotal

- Taxes

- Total Amount Due

- Payment Terms (Due Date, Accepted Payment Methods)

Essential Elements of a Receipt

A receipt is the opposite of an invoice; it’s proof that payment has already been made. It’s like a ‘thank you’ note for the money received. This document confirms the transaction is complete. Like an invoice, a receipt should have the seller’s business name and contact details. It also needs to clearly state the date the payment was received and the total amount paid. A breakdown of what was purchased is usually included, similar to an invoice, but the focus here is on the payment itself.

Receipts are your proof of purchase. They’re what you hold onto for returns, warranties, or just to know where your money went. For businesses, a receipt is proof of income. It’s important that the receipt accurately reflects the payment received. This document closes the loop on the financial transaction.

Key things to look for on a receipt:

- Seller’s Business Name and Contact Info

- Date of Payment

- Total Amount Paid

- Description of Goods/Services Purchased

- Payment Method Used (e.g., cash, credit card, check)

- Receipt Number (often similar to an invoice number but indicates payment)

When Each Document Is Issued in a Transaction

The timing of these documents is what really sets them apart. An invoice is sent before payment is made. It’s issued by the seller to the buyer to let them know what they owe and when it’s due. This happens when goods are delivered on credit or services are rendered with payment to follow. The invoice initiates the payment process.

On the other hand, a receipt is issued after payment has been received. It serves as confirmation that the seller has gotten the money from the buyer. This happens immediately in cash transactions or once a payment is processed for an invoice. The receipt concludes the financial part of the transaction.

The sequence is simple: Invoice first, then Receipt. One asks for money, the other confirms it’s been paid.

For example, if you order custom furniture, you’ll likely get an invoice detailing the cost and payment terms. Once you pay, you’ll receive a receipt as proof of your payment. In a retail store, you pay at the counter, and you get a receipt right away because the payment and transaction are simultaneous. The invoice is more for services or larger purchases where payment isn’t immediate.

The Importance of Distinguishing Invoices from Receipts

Why Accurate Record-Keeping Matters

Keeping track of financial documents is a big deal for any business. It’s not just about knowing who owes what, but also about having a clear picture of money coming in and going out. This careful attention to detail helps prevent mix-ups later on. When you know the difference between an invoice and a receipt, you’re building a solid foundation for your business’s financial health. This clarity is key.

Think of it like this: an invoice is a request, a promise of payment. A receipt is the proof that the promise was kept. Without this distinction, it’s easy to get confused about outstanding payments versus completed transactions. This confusion can lead to errors in your books, making it harder to see where your money is actually going. Accurate record-keeping, starting with understanding these documents, is vital.

Properly distinguishing between an invoice and a receipt is fundamental for maintaining organized and reliable financial records. This practice helps avoid double-counting payments or missing payments altogether. It’s a simple step that pays off big time in the long run, making your financial life much smoother.

Impact on Financial Planning and Cash Flow

Understanding the difference between an invoice and a receipt directly impacts how a business plans its finances. Invoices represent future income, showing what customers are expected to pay. This helps in forecasting cash flow, allowing businesses to anticipate when money will arrive. It’s like looking at your upcoming paychecks to plan your expenses.

Receipts, on the other hand, confirm that money has been received. They are proof of completed sales and actual cash inflow. By tracking receipts, businesses can see their current financial standing and verify that their forecasted income is materializing. This helps in making real-time adjustments to spending and investment plans.

Effective management of both invoices and receipts provides a clear view of financial health, enabling better budgeting and strategic decision-making. This clarity is essential for sustainable growth.

Role in Dispute Resolution and Audits

When disagreements arise, having the right documents is incredibly important. An invoice outlines the agreed-upon terms of a sale, including the price and services rendered. If a customer disputes a charge, the invoice serves as the initial agreement.

A receipt then acts as proof that the payment for that agreed-upon amount was made. This combination of invoice and receipt is powerful evidence. It shows what was expected and what was delivered, helping to settle disputes quickly and fairly. For audits, these documents are non-negotiable.

- Invoices:Detail the sale and payment request.

- Receipts:Confirm payment has been made.

- Both:Provide a complete transaction history.

Auditors need to see this clear trail of transactions to verify financial accuracy. Without them, a business can face serious problems during an audit, potentially leading to penalties or legal issues. The distinction between an invoice and a receipt is therefore critical for compliance and peace of mind.

Accounting and Legal Implications

How Invoices and Receipts Affect Financial Statements

An invoice, before it’s paid, shows up as an ‘accounts receivable’ on a company’s books. This means money is owed to the business. It’s a promise of future cash. Once that invoice is paid, the money comes in, and the accounts receivable balance goes down. The cash balance, however, goes up.

A receipt, on the other hand, is proof that money has already changed hands. For the seller, a receipt confirms income and the cash received. For the buyer, it confirms an expense and the cash paid out. These documents are key for making sure the company’s financial statements accurately reflect what’s happening with its money. Keeping good records of both an invoice and a receipt is important.

Think of it like this: the invoice is the ‘bill’ you send out, and the receipt is the ‘thank you’ for the payment. Both tell a different part of the money story.

Legal Weight and Contractual Obligations

When a business sends an invoice, it’s more than just a bill. It can be seen as a legal document that creates a debt. It outlines what was sold and how much is owed. If a customer doesn’t pay, that invoice can be used as evidence in court to get the money. It sets the terms of the deal.

A receipt, however, is proof that the deal is done and paid for. It shows the transaction happened. This is super important if there’s a disagreement later, like a warranty claim or a return. The receipt backs up the buyer’s claim that they paid.

Both the invoice and the receipt have legal standing, but they prove different things. One asks for payment, the other confirms it. Proper handling of each document is key for legal protection.

Ensuring Compliance Through Proper Documentation

Accurate record-keeping with invoices and receipts is vital for staying on the right side of the law, especially when it comes to taxes. Tax agencies want to see proof of income and expenses. A well-documented sales process, starting with a clear invoice and ending with a detailed receipt, makes tax filing much smoother.

This documentation helps businesses prove their reported income and justify their expenses. It’s also what auditors look for. Without proper records, a business could face penalties or have trouble proving its financial activities.

Keeping organized records of every invoice and receipt isn’t just good practice; it’s a requirement for legal and financial health. It simplifies audits and tax seasons significantly.

Practical Application in Business Transactions

When to Use an Invoice

An invoice is your formal request for payment. You’ll issue an invoice when you’ve provided goods or services but haven’t yet received payment. Think of it as a bill that clearly outlines what’s owed, the due date, and how the customer can pay. This document is key for tracking money that’s coming your way.

For example, if a client hires your design firm for a project, you’d send an invoice detailing the services rendered and the total cost. This invoice serves as a record of the debt owed to your business. It’s important to get the invoice right, with all the details clear, to avoid confusion later on.

The invoice is the first step in the payment process for many business dealings. It sets the stage for the transaction and establishes the financial obligation. Without a proper invoice, tracking accounts receivable becomes a messy affair, impacting cash flow projections.

When to Use a Receipt

A receipt is your confirmation that payment has been successfully made. You issue a receipt after the customer has paid. It’s proof of purchase for them and proof of income for you. This document is vital for customer satisfaction and your own financial records.

Imagine a retail store. When a customer buys a shirt and pays at the counter, they get a receipt. This receipt shows what they bought, how much they paid, and when. It’s their evidence if they need to return the shirt or for their personal budgeting.

Receipts are more than just paper; they are evidence. They confirm that a transaction is complete and paid for. This is important for both parties involved in the sale.

Transactions Requiring Both Documents

Some business transactions naturally involve both an invoice and a receipt. This typically happens when there’s a delay between the service or product delivery and the final payment, or when a deposit is involved. Understanding when to use each document is key to good accounting.

Consider a contractor hired for a large renovation. They might issue an invoice for the initial deposit, then another invoice for the work completed halfway through, and finally, a receipt once the final payment is made. Each step requires the correct documentation.

Proper use of both invoices and receipts creates a clear financial trail, minimizing disputes and simplifying audits. It shows professionalism and attention to detail in your business operations.

Streamlining Financial Documentation

Making sure your financial paperwork is neat and tidy doesn’t have to be a headache. When it comes to invoices and receipts, a little bit of organization goes a long way. Think of it as setting up your business for smooth sailing, not just for yourself, but for anyone who needs to look at your books.

Creating clear and effective invoices is the first step. This means making sure every invoice has all the right details: who it’s for, what was sold, how much it costs, and when payment is due. Using templates can really help here. They keep things looking professional and make sure you don’t forget anything important. A well-made invoice gets you paid faster and avoids confusion.

Generating accurate and useful receipts is the next piece of the puzzle. A receipt is proof that you’ve been paid. It should clearly show the amount paid and the date. This is important for your records and for your customers. When both invoices and receipts are handled properly, it makes tracking money in and out much simpler. It’s all about making financial tasks less of a chore and more straightforward.

Creating Clear and Effective Invoices

An invoice is your formal request for payment. To make sure it does its job well, it needs to be clear and complete. Start with a clear label: “Invoice.” Then, add your business details – name, address, contact info. Next, put in the customer’s information. A unique invoice number and the date it was issued are also key. Don’t forget the payment due date.

Itemizing what you’re charging for is super important. List each product or service with its description, quantity, and price. This breakdown helps customers understand what they’re paying for. Finally, calculate the total amount due, including any taxes or discounts. Clearly state your accepted payment methods. A well-structured invoice speeds up payments and reduces questions.

Here’s a quick look at what makes a good invoice:

- Clear “Invoice” label

- Your business and customer details

- Unique invoice number and dates

- Itemized list of goods/services with prices

- Total amount due and payment terms

Generating Accurate and Useful Receipts

A receipt is the confirmation that a payment has been successfully made. It’s the final step in a transaction, showing that the books are balanced for that particular sale. When creating a receipt, accuracy is paramount. It should clearly state the date of the transaction, the total amount paid, and the method of payment used. Sometimes, a brief description of what was purchased is also included.

Think of a receipt as a customer’s proof of purchase. It’s useful for them if they need to return an item or for their own record-keeping. For your business, receipts are vital for tracking income and for tax purposes. They provide a clear record of money received, which helps in managing cash flow and preparing financial statements. A good receipt builds trust and shows professionalism.

Key elements of a receipt:

- Transaction date

- Total amount paid

- Payment method

- Business name and contact information

- (Optional) Brief description of goods/services

Leveraging Technology for Efficiency

In today’s world, technology can make managing invoices and receipts much easier. Software designed for accounting or billing can automate many of the repetitive tasks. This means less time spent on data entry and more time focusing on running the business. Automated systems can generate invoices based on templates, send them out, and even track payments.

Digital receipt management is also a big help. Instead of piles of paper, businesses can store receipts electronically. This makes them easy to find when needed, whether for a customer inquiry or an audit. Many accounting programs can link directly to bank accounts, helping to match payments to invoices and receipts automatically. This integration reduces errors and gives a clearer picture of the company’s financial health.

Using technology isn’t just about saving time; it’s about improving accuracy and making financial information more accessible. It helps keep everything organized and reduces the chances of mistakes slipping through the cracks.

Here’s how technology helps:

- Automated invoice creation and sending

- Digital storage and easy retrieval of receipts

- Integration with accounting software for reconciliation

- Reduced manual data entry and fewer errors

Wrapping It Up

So, there you have it. Invoices are like a bill you get before you pay, telling you what you owe and when. Receipts, on the other hand, are what you get after you’ve paid, proving that the money changed hands. They might seem similar, and yeah, they both deal with money changing hands, but they happen at different times and for different reasons. Knowing the difference helps keep your business stuff organized, makes sure you’re on the right track with taxes, and just generally makes dealing with customers smoother. It’s not super complicated, but getting it right makes a big difference in how smoothly your business runs.